3 Reasons You Should Choose A Flat Fee Financial Advisor

Feb 15, 2024

Thinking about switching to a flat fee advisor? This guide covers what you need to know. Use the table of contents below to find the sections that matter most to you.

The Evolution of Financial Advice and Why Flat Fees Matter Now

If your advisor charges you more as your investment account grows, without offering more value, it might be time to rethink the relationship. Here’s a little-known tip: If your investment accounts exceed $1 million, a flat fee financial advisor could make a lot more sense for you.

The way consumers have paid for financial advice has changed a few times within the past few decades. For many years the only way to access the stock market was through a “broker” who would place trades for you in exchange for a commission. As access to the stock market became easier through the internet, the financial services industry pivoted to charging clients an advisory fee based on the assets under their management. This shift helped eliminate the inherent conflicts that were present for the “I only get paid when I make a trade” commission-based model, but the AUM advisory fee model wasn’t without conflicts either.

Eventually, many investors who were paying a percentage-based advisory fee started to ask a few questions like:

- Does my $3 million portfolio really require three times as much work as someone's $1 million portfolio?

- Why does my advisor never want me to spend my money?

- Why does my financial advisor charge me more than my CPA and attorney combined?

Fair questions, right?

Enter an advisory model that is quickly gaining momentum: The flat-fee financial advisor. For those with larger account balances, this could be an excellent choice for three key reasons.

1) Flat Fee Financial Advice Reduces Conflicts of Interest

Let’s be honest: if your advisor’s income is tied directly to the size of your portfolio, there’s always going to be a conflict—whether they admit it or not. Financial decisions should be based on your life goals, not how much your advisor gets paid.

Here’s a real-world example: a client finds their dream home—a $1 million property close to family—and asks their advisor if it makes sense to pay cash. Sounds simple enough, right? But if that advisor charges 1% of assets, recommending a cash purchase means a $10,000 annual pay cut. That’s a tough pill to swallow, even for the most ethical professionals.

And the conflicts don’t stop there. Let’s say you’ve already saved enough to retire comfortably. You don’t need to chase big returns—but your advisor’s compensation goes up if your portfolio grows. That’s a subtle nudge toward more risk than you may need.

This is where flat fee advisors shine. Because their compensation doesn’t rise or fall based on your account size, they’re free to focus on what really matters: your goals, your plan, your peace of mind. No hidden incentive. Just advice tailored to what’s best for you.

Now, to be fair, the AUM model has been marketed well. You’ve probably heard, “When we do better, you do better.” It sounds great. But isn’t that what fiduciary duty is for? A fiduciary is supposed to act in your best interest—regardless of how they get paid.

2) Flat Fee Advisors Focus More on Planning—Not Just Performance

One of the biggest shifts I’ve seen when working with flat fee clients? The conversation changes. Instead of spending every meeting talking about the S&P 500 or this quarter’s returns, we dig into the stuff that actually matters—taxes, withdrawal strategies, Social Security timing, and how to make your money last.

It’s not that investment performance doesn’t matter. Of course it does. It’s the engine that powers the plan. But flat fee advisors know they can’t just ride market returns and collect a percentage. They have to show up and deliver real planning value.

And honestly? That’s what most people want anyway. You’re not hiring an advisor because you think they have a secret stock-picking formula. You’re hiring them because you want a partner who helps you make smart, confident decisions for the next 30 years.

When the fee isn’t tied to portfolio size, the conversation becomes more about your life and less about your balance. That’s a shift worth paying attention to.

3) Flat Fees Are Generally MUCH Lower

On the surface, a 1% advisory fee might not sound like much. But over time, that small percentage can quietly siphon hundreds of thousands from your retirement savings.

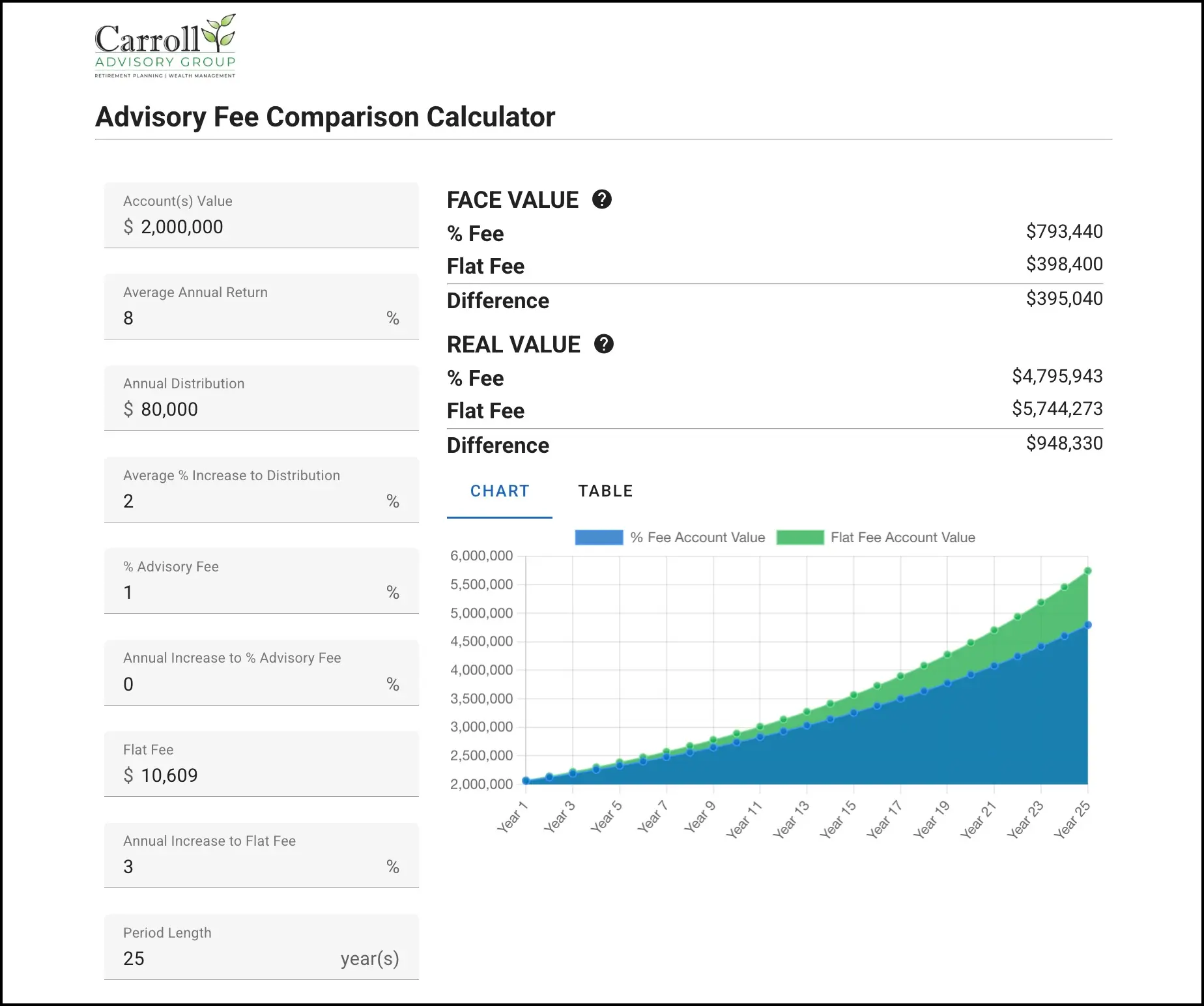

Let’s walk through a real example:

- Portfolio: $2,000,000

- Annual withdrawal: 4% for living expenses

- 1% traditional advisory fee over 25 years: $793,440

- Flat fee alternative (starting at $10,609/year with 3% inflation adjustment): $398,400

Direct savings: $395,040

But here’s the kicker: that’s just the raw savings. When you factor in the opportunity cost—the extra money staying invested and compounding at 8%—the true impact balloons to around $948,330.

That’s not pocket change. That could be a few extra years of financial freedom, a major legacy gift to your family, or simply the peace of mind that you’ll never need to downsize your lifestyle later on.

Here’s a quick glimpse from my Fee Impact Calculator:

And it's not just about the dollars. With a flat fee, your costs are simple, predictable, and easy to track—no more squinting at quarterly statements trying to figure out if your fee just quietly crept up again.

If you want to run your own numbers and see what a flat fee could save you, try the Fee Impact Calculator here.

Who Should NOT Use a Flat Fee Financial Advisor

Flat fees can be a game-changer for many investors—but not for everyone.

If your investment portfolio is relatively small, or if your financial needs are pretty straightforward, paying a flat annual fee might not be the best deal. In some cases, a traditional percentage-based (AUM) fee could actually cost you less, especially if you’re mainly looking for investment management without much ongoing planning support.

For DIY investors who feel confident managing their own portfolios, there’s another option worth considering: hiring an advisor on an hourly basis. You can get help setting up a smart, diversified plan—and then check in every few years or when major life changes happen, without paying for ongoing service you don’t really need.

This kind of arrangement often works well for people who:

- Have clear goals and prefer to manage investments day-to-day themselves

- Only need occasional guidance, not full-time financial planning

- Want professional input without ongoing costs stacking up

At the end of the day, the best advisory model is the one that matches your complexity, your comfort level, and the kind of support you actually need. Flat fees offer transparency and deeper planning, but they work best when you truly want to lean into everything a full advisory relationship can provide.

How To Find a Flat Fee Financial Advisor

There’s a growing movement of advisors breaking away from the old percentage-based model—and flat fee firms are leading the charge. I'm proud to say that includes us.

At Carroll Advisory Group, we work with clients who have between $1 million and $12 million in investable assets, helping them build retirement plans that are personal, predictable, and fee-transparent from day one. If you want to explore whether a flat fee relationship fits your needs, let’s connect.

Prefer to explore a few options? No problem. The Flat Fee Advisors Directory is a great place to find reputable advisors across the country who follow this model.

Whichever path you choose, remember this: the right advisor should feel like a partner, not a salesperson. Your financial plan should be built around your goals—not around maximizing someone else's fee.

Choosing a flat fee advisor can give you the transparency, independence, and peace of mind that many traditional models struggle to deliver. But like anything in finance, it’s not one-size-fits-all. The best choice is the one that fits your complexity, your comfort level, and the life you want to live.

Frequently Asked Questions

When does a flat fee financial advisor make the most sense?

Flat fee advisors are ideal for individuals with over $1 million in investable assets who want comprehensive retirement planning and greater fee transparency. The more your portfolio grows, the more value you’ll see from flat pricing.

Are flat fees always cheaper than AUM fees?

Not always—but they often are once your portfolio exceeds a certain size. With a $2M portfolio, for example, the long-term savings from flat fees can reach hundreds of thousands when compared to a typical 1% AUM fee.

Does a flat fee advisor still provide investment management?

Yes. Most flat fee advisors manage investments just like AUM-based advisors—but the fee structure disconnects compensation from portfolio size, reducing conflicts of interest and encouraging more planning-centric conversations.

How do flat fees reduce conflicts of interest?

Flat fees aren’t tied to the size of your portfolio, so advisors have no financial incentive to discourage spending, delay debt payoff, or increase investment risk unnecessarily. This helps ensure recommendations align with your goals—not their revenue.

What’s included in a flat fee financial planning relationship?

This varies by firm, but generally includes retirement income planning, tax strategies, Social Security optimization, estate considerations, and ongoing investment management—without any hidden costs based on your asset size.

How do I compare flat fee and AUM costs?

Use our Fee Impact Calculator to compare advisory fees over time based on your portfolio and expected retirement timeline. It’s a simple way to estimate how much you could save.

Is a flat fee advisor still a fiduciary?

Yes. Fiduciary responsibility is about acting in your best interest—regardless of compensation model. But flat fees can enhance fiduciary alignment by removing portfolio-based revenue conflicts.

Can I find a flat fee advisor near me?

If you’re not ready to work with us, visit the Flat Fee Advisors Directory to browse other vetted professionals across the U.S. who use this model.