Boldin: Planning for Long Term Care

Apr 16, 2025

Many of my readers know I’m a big fan of Boldin. For those unfamiliar, Boldin (formerly known as NewRetirement) is a retirement planning software that helps individuals build and test their own retirement income plans. It’s one of my favorite tools for DIYers who want clarity and control as they start planning for retirement.

One area where Boldin offers lots of options is in modeling long-term care costs. Getting those numbers dialed in can take a few creative workarounds, but that’s true even with expensive professional planning tools.

Why Long-Term Care Belongs in Your Plan

Including potential long-term care costs in your retirement plan is critically important. According to recent data, six in ten people turning 65 will eventually need help with daily activities such as dressing, transportation, or preparing meals.

To put that into perspective:

- The average driver has a 2% chance of being in a car accident each year, yet nearly everyone carries car insurance.

- The odds of a house fire are just 0.03% annually, but most homeowners still carry insurance.

Unlike those risks, where insurance is relatively affordable, long-term care coverage is often much more expensive. As a result, many people explore alternative ways to manage this potential cost. Of these potential strategies, self-insuring is often the preferred option for higher net worth retirees.

This approach means covering care expenses directly from your savings and assets, without relying on insurance or government programs. To do this effectively, most people project at least two years of care, with some choosing to plan for three or four years depending on their comfort level and risk tolerance.

These costs are usually added toward the later years of a retirement plan, which increases projected income needs during that time. By incorporating this into your retirement income projections, you can help ensure your plan is fully stress-tested against this significant risk.

Understanding Boldin’s Built-In Long-Term Care Tools

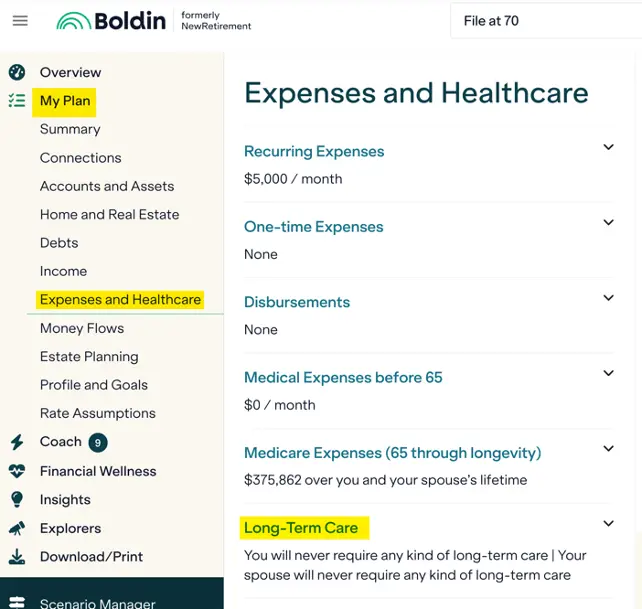

Boldin offers several built-in options to model long-term care, found under My Plan > Expenses and Healthcare near the bottom of the expenses section. If you're married, be sure to make separate selections for each spouse.

Key Assumptions in Boldin’s Native LTC Model

Boldin's built-in long-term care model assumes:

- Care will occur during the final 28 months of your life

- Care will follow a two-phase cost model:

- Months 1–12: 33% of the national average for assisted living

- Months 13–28: 100% of the national average

💡 Example: Modeling Assisted Living Costs

Based on the 2024 Genworth/CareScout survey, the median cost for assisted living is $5,900/month.

- Months 1–12: $1,966/month

- Months 13–28: $5,900/month

Total cost: $117,992 in today’s dollars, automatically inflated over time based on your medical inflation settings.

These assumptions are fixed and cannot be customized within the built-in tool, which is why I prefer using a workaround for more precise modeling.

What Each Boldin LTC Option Means

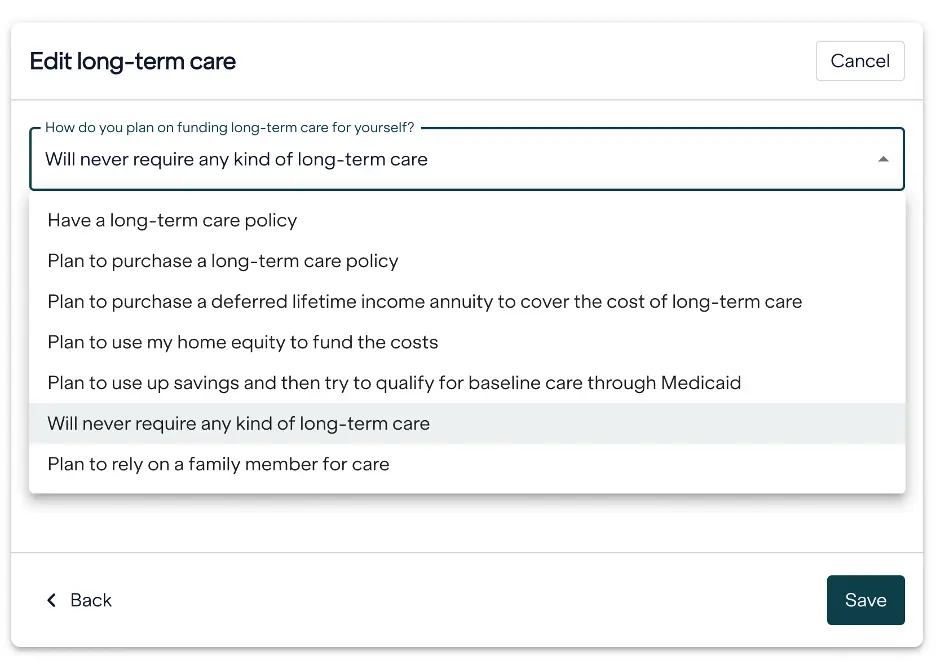

Within the long-term care section, there are multiple selections you can make for funding this future expense.

Each selection impacts your plan differently, so it’s important to understand how Boldin models each one behind the scenes. Here’s what each selection means:

1. Have a long-term care policy (or plan to purchase one)

Boldin assumes the policy will cover 80% of long-term care costs over the final 28 months. The remaining 20% is added as an expense. Be sure to add the premium payments manually under recurring expenses.

2. Plan to Purchase a Deferred Lifetime Income Annuity

Boldin adds long-term care costs in the final 28 months but assumes you'll have income from an annuity to cover some or all of them. If you go this route, adjust your account balances under My Plan > Accounts and Assets to reflect the funds allocated to the annuity.

3. Plan to Use Home Equity

You can model this in two ways:

- Reverse Mortgage: Under "Homes and Real Estate > Future Changes," select the age to initiate it. In Boldin, a reverse mortgage is treated as a line of credit. It’s only used after all after-tax savings have been depleted and before retirement accounts are tapped.

- Selling Your Home: If you choose to sell your home to cover long-term care expenses, you’ll enter the age at which the sale will occur. Boldin will prefill the estimated home value and any remaining mortgage balance.

You’ll also be prompted to select an account to deposit the sale proceeds into. If you only have retirement accounts (like a Traditional or Roth IRA), Boldin may require you to use one of them. To work around this, go to Accounts & Assets and create a new after-tax account with a nominal balance (e.g., $1).

4. Use Savings then Qualify for Medicaid

This is Boldin’s default. It assumes care will be paid from savings until depleted, then funded by Medicaid.

5. Will never require any kind of long-term care (or plan to rely on a family member)

Boldin assumes no long-term care expenses. These options are best used when you plan to enter your own disbursements manually.

A More Precise Way to Plan for Long-Term Care in Boldin

While Boldin’s default settings are helpful, many users prefer to test variations based on their personal experiences, family history, or financial comfort level. Two common adjustments I often recommend are modifying the care duration and the cost assumptions.

Adjusting the Duration of Care

By default, Boldin assumes long-term care will last 28 months. That might feel reasonable, but you can model three to five years of care, especially if your family history suggests longer needs. There’s no single “right” answer, but exploring different timelines helps you understand how long-term care could affect your overall financial flexibility.

Customizing the Cost Assumption Based on Location and Type of Care

The software uses a national average for long-term care costs, which is a useful starting point but not very precise. Costs vary widely by location and type of care. For example, here are 2024 monthly costs for a private nursing home:

- Texas: $6,692/month

- National average: $9,733/month

- New York: $13,535/month

These differences can significantly affect your plan, especially if you’re working with a fixed income or region-specific goals.

How to Build Your Custom Long-Term Care Plan in Boldin

For long-term care planning, I prefer to turn off Boldin’s built-in tool entirely and use a custom workaround instead. For those who like to get into the details, this can give you much more precision and control. Here are the steps:

Step 1: Turn Off Boldin’s Default LTC Modeling

Select “Will never require any kind of long-term care” in the planning section. This ensures no automated expenses are added.

Step 2: Determine Accurate Local Costs

Use the CareScout Cost of Care Survey to find costs for your area. Choose “Annual” as the cost period, set the year care will begin, and adjust the inflation rate based on your expectations.

- In-home care

- Assisted living

- Nursing home care

You can use a blended estimate or create different stages based on care needs.

Step 3: Use Disbursements to Model Custom Care

Navigate to My Plan > Expenses and Healthcare > Disbursements. Add individual disbursements for each year of care you expect to plan for.

Enter each projected care year as a separate disbursement. For example:

- 2048: $161,488 for assisted living from an IRA (marked tax-deductible)

Add notes so you remember what each entry is for. If married, repeat the process for your spouse.

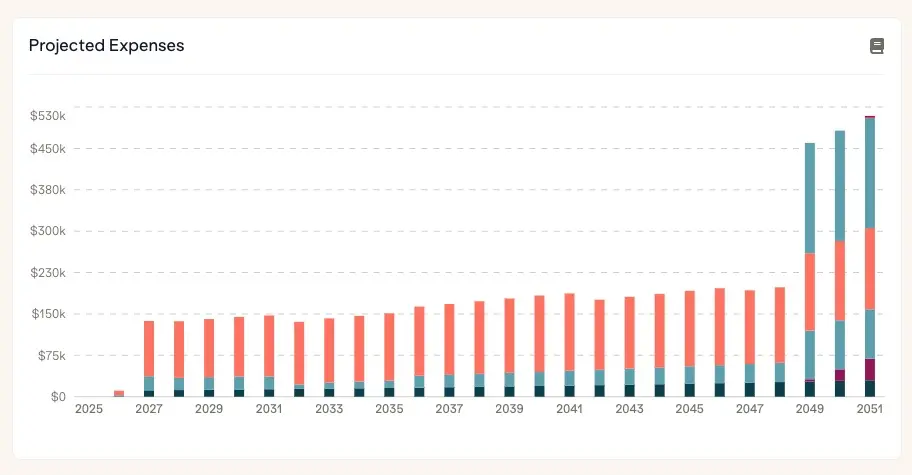

Step 4: View Your Results

You can view the results on the same page where you entered the disbursement. On the right side of the screen, scroll to the Projected Expenses bar chart. You should see the years with increased long-term care costs.

Planning for long-term care isn’t about fear—it’s about removing uncertainty from your retirement plan. Boldin provides a strong foundation, but customizing the duration, cost assumptions, and care types creates a plan that’s more accurate and resilient.

Whether you're just getting started or refining your Boldin plan, this is one area where going the extra step really pays off. Your future self, and your family, will thank you.