Bear Markets Happen. Smart People Don’t Panic.

Apr 08, 2025

It takes a lot for market volatility to shake me. Over the past two decades, I’ve watched the market react to everything from housing bubbles to pandemics to flash crashes. Through it all, one truth has held up: staying calm and staying invested is what works.

Still, I get it. Sharp market drops, especially the kind we’ve seen recently, can rattle even seasoned investors. For new retirees or those just entering that phase of life, it can feel even more personal. After all, this isn’t just about numbers on a screen. It’s your future.

So let’s talk about what’s actually happening, what history tells us, and why panicking is the one decision that almost always leads to regret. Because while bear markets may feel like the exception, they’re actually a normal and even necessary part of long-term investing.

Market Drops Feel Different in Retirement And That’s Normal

First, it’s important to recognize that market drops do feel worse in retirement.

When you're working, market dips are mostly background noise. You're still contributing to your accounts, and you know time is on your side. The focus is on growth, and a bad quarter doesn’t really change your long-term trajectory.

But retirement changes everything.

You’re no longer adding to your accounts. You’re drawing from them. And that simple shift turns volatility from a statistic into something that feels personal. A 10 percent drop in the market isn’t just a headline anymore. It’s a hit to the portfolio you now depend on for income.

I wrote more about this in 5 Things No One Tells You About Retirement, where I explained how this shift in perspective is one of the most underrated challenges retirees face. Not only do you feel more vulnerable to losses, but you also have more time on your hands. That often means more time spent watching the news, reading headlines, and worrying about things you used to ignore.

So these feelings you have? Completely normal. You’re not doing anything wrong by feeling uneasy.

And this is also why the usual advice to “stay the course” can feel inadequate—especially for new retirees. A recent MarketWatch headline captured this frustration:

“As the S&P 500 crashes, this new retiree says advisers are ‘head-in-the-sand clueless.’ The standard ‘stay the course’ is little salve to new retirees who face the most risk in a downturn.”

And honestly, that’s a fair critique. Up to a point.

We know that clients don’t want clichés when the market drops 10, 15, or even 20 percent. They want clarity, perspective, and a sense that someone is actively thinking about their specific situation.

As advisors, we need to do more than repeat old lines. We need to acknowledge the fear, the vulnerability, and the very real psychological weight of seeing a portfolio decline. We need to “mourn with those who mourn.” But we also need to offer more than empathy. We need to offer strategy.

Because the truth is, market volatility can also be an opportunity:

- Rebalancing when stocks are cheaper and bonds are relatively expensive

- Harvesting losses to offset future tax bills

- Converting to Roth accounts at temporarily lower valuations

- Adjusting withdrawal strategies to create more flexibility

These are not reactive moves. These are proactive, intentional strategies that come from having a plan in place and the discipline to follow it even when it feels hard.

So yes, market downturns can feel more intense in retirement. That’s real. But letting fear drive your decisions is what puts your plan at risk because while the details of each market drop may vary, the underlying story is remarkably consistent. Markets move in cycles. Declines are followed by recoveries. And those who stay invested with discipline and perspective are the ones who come out ahead.

Reacting out of fear, abandoning a sound strategy, or trying to outguess every dip is not the mark of a seasoned investor or financial advisor. It’s a mistake often made by amateurs without a solid plan. That may sound harsh, but the data is clear: Real wealth is built by staying invested, making thoughtful, tactical decisions within a long-term framework, and resisting the urge to outsmart the market during moments of stress.

Market Drops Happen Every Single Year

If you need more than just perspective, the numbers are there to back it up.

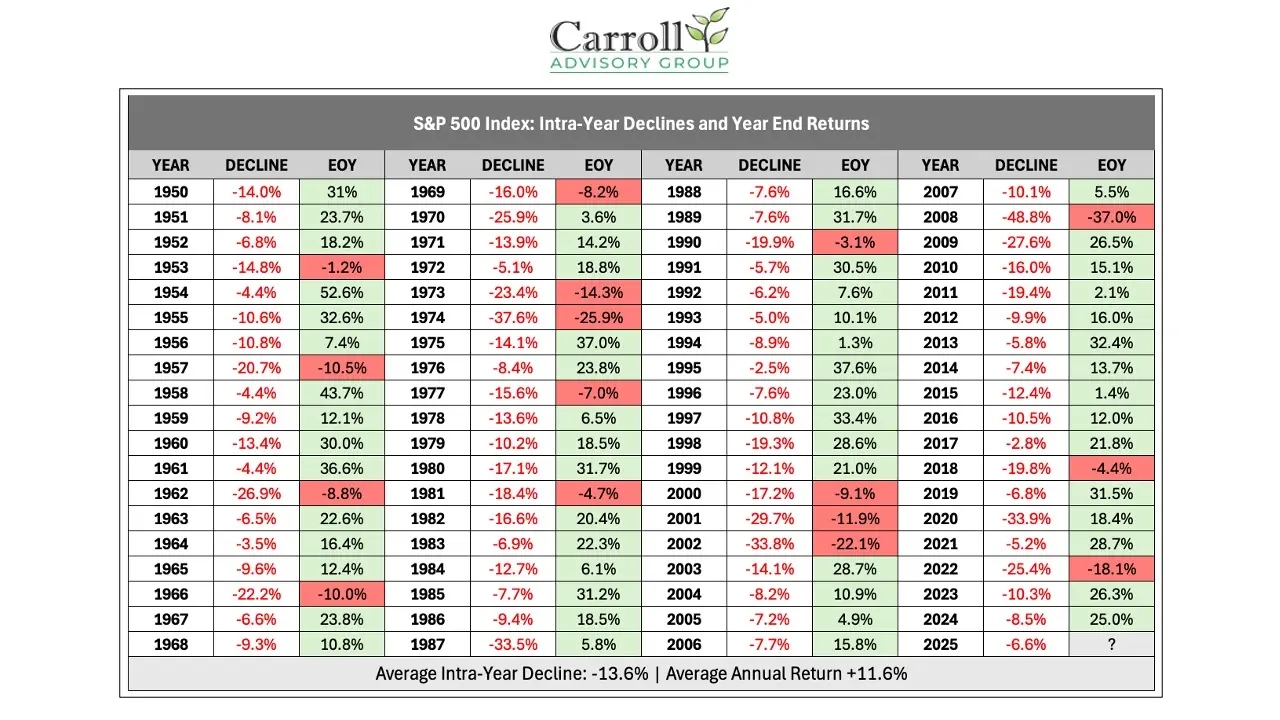

Market declines may feel alarming in the moment, but they’re far from unusual. In fact, they happen every single year. Since 1950, the market has experienced an intra-year drop in every calendar year. Sometimes they are mild, sometimes sharp.

The chart below highlights this, showing each year’s largest decline alongside where the market ultimately finished.

What stands out? A few key things. First, the average intra-year drop over the past 75 years has been about 13.6 percent. A decline of that size will always get your attention. Second, despite those declines, the market finished higher in 59 out of 75 years. That’s nearly 80 percent of the time. In other words, down years are the exception. And just because the market is down now doesn’t mean it will finish the year that way.

Missing Just a Few Days Can Cost You Everything

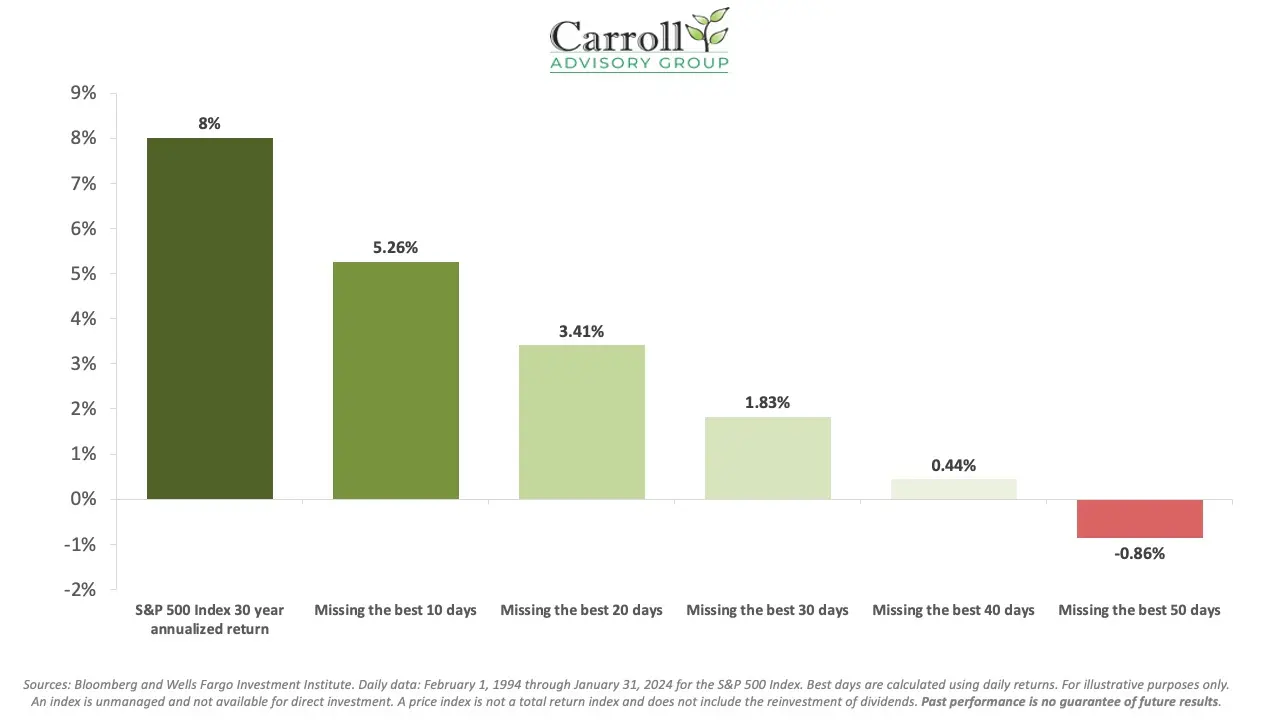

The second big reminder comes from a chart that’s been making the rounds for years — and for good reason. It’s simple, compelling, and still incredibly relevant.

This chart looks at the 30-year period ending in January 2024, during which the S&P 500 delivered an average annual return of 8 percent. That’s across roughly 7,500 trading days that included the dot-com crash, the financial crisis, the COVID selloff, and the 2022 bear market and lots of other smaller crises that most of us have forgotten.

But here’s what’s so powerful: if you missed just a handful of the market’s best days during that stretch, your return was dramatically lower.

- Miss the 10 best days? Your return drops to 5.26%

- Miss the best 20 days? 3.41%

- Miss the best 30? 1.83%

- Miss the best 40? Just 0.44%

- And if you missed the 50 best days (only 0.7% of the total trading days!) your return actually goes negative at -0.86%.

Let that sink in…missing just 50 of the best-performing days out of more than 7,000 would have meant the difference between building wealth and losing money. That’s how concentrated market returns really are.

Why Timing the Market Backfires: The Clustering Effect

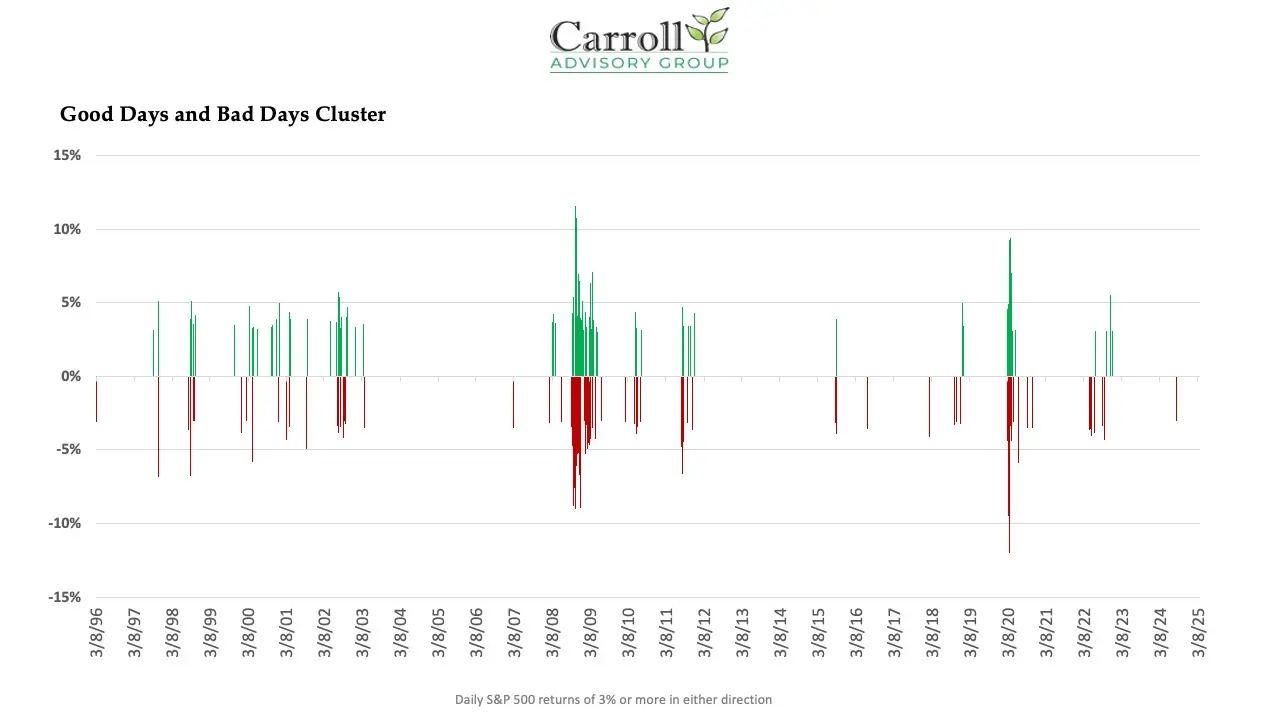

The “missing the best days” chart is compelling on its own — it clearly shows how just a handful of days drive the bulk of long-term returns. But it also raises an important question: Why is it so easy to miss those days?

Here’s the answer: the best days tend to show up right next to the worst ones.

If you look more closely at the data, it becomes clear that good days and bad days aren’t evenly spread out. They tend to cluster. You often see a big up day just one or two days after a major drop. In fact, some of the market’s strongest single-day rebounds have come immediately after panic-driven selloffs.

It’s like rain and rainbows — you only get the rainbow after the storm.

To illustrate this, we can look at all the days from that same 30-year period when the market moved more than 3 percent in either direction. What you'll notice right away is that the big gains and big losses are neighbors. In many cases, trying to sidestep the worst days almost guarantees you’ll miss the best ones too.

This is why staying invested is so critical. If you panic and pull out during a market drop, you’re likely missing the very days that do the most to power your long-term returns.

Your Plan Was Built for Times Like This

Here’s the third and most important reminder: if you have a solid retirement income plan built by someone who understands the risks of retirement, then moments like these have already been accounted for.

We don’t assume smooth markets when building retirement plans. Quite the opposite. Every plan we create is stress-tested against thousands of possible return scenarios including the worst ones. We use conservative assumptions, knowing full well that markets don’t move in straight lines. The goal isn’t to avoid volatility. It’s to make sure you can survive it.

We also build a structure that gives you breathing room.

One of the core planning tools we use is a 5-year spending bucket. This is a pool of fixed income investments that are matched to your anticipated withdrawals over the next several years. That way, when markets are down, you don’t have to sell from your long-term investments to generate income. You already have your income needs covered.

And historically, that’s more than enough time.

If we look back at every bear market since 1950, the average time it has taken the market to recover from peak to peak is 33 months — just under 3 years. That means a well-structured 5-year spending bucket gives you a buffer that has historically outlasted every major market downturn.

So yes, this market may feel uncertain. And yes, it could still drop further. But that’s not a reason to worry.

Because your plan wasn’t built for the easy years. It was built for years like this.

If Your Plan Doesn’t Give You Confidence, Let’s Fix That

Everything we’ve covered here points to one thing: peace of mind in retirement comes from having a plan that’s built to weather storms.

If your current plan isn’t giving you that sense of clarity and confidence, don’t wait for the next market drop to find out what’s missing.

Schedule a Retirement Clarity Meeting and let’s get you on the path to a strategy you can actually trust no matter what the market is doing.