How Sequence of Returns Risk Affects Your Social Security Filing Strategy

Mar 23, 2025

When most people think about when to file for Social Security, they usually don’t factor in what’s happening in the stock market. But they should.

Your Social Security filing strategy plays a critical role in your overall retirement income plan — especially when it comes to protecting your portfolio against sequence of returns risk. In some cases, filing early can be a smart, strategic move. In this article, we’ll walk through what sequence of returns risk actually is, why many experts give overly simplistic Social Security advice, and how real-life scenarios can challenge that conventional wisdom.

What Is Sequence of Returns Risk?

Sequence of returns risk refers to the danger of experiencing poor investment returns in the early years of retirement — when you're starting to withdraw from your portfolio. It’s not just about how much your portfolio earns over time. It's about when those returns happen.

To illustrate this, let me tell you a story I often share in my workshops.

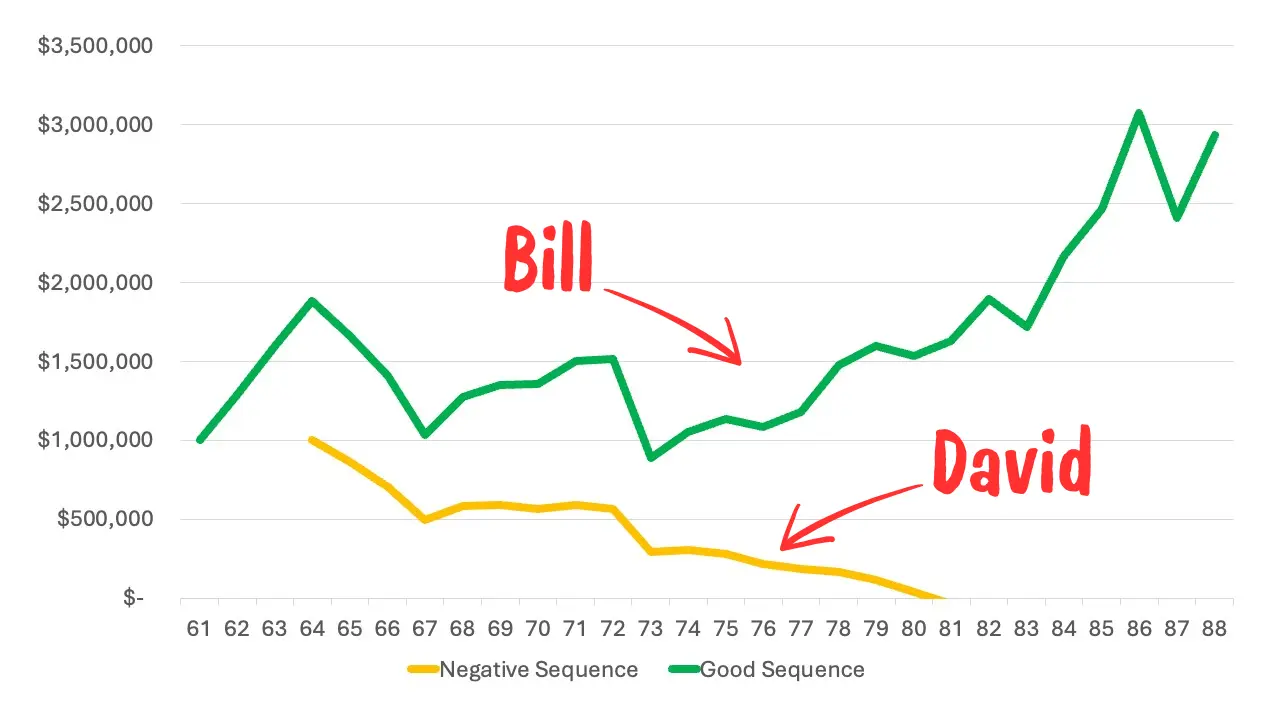

The Story of Bill and David

Bill and David were coworkers who both planned to retire with $1 million saved. Bill reached his goal first, retiring at the end of 1996. He stayed fully invested in stocks, took a 5% distribution, and increased his withdrawals each year by 3% for inflation.

A few years later, David hit the same savings milestone in 1999 and followed the same strategy Bill used.

But they had dramatically different outcomes.

-

Bill, who retired in a strong market, saw his portfolio grow and enjoyed a successful retirement.

-

David, who retired just before the tech crash, experienced three consecutive down years in the market. The combination of withdrawals and poor returns caused his portfolio to drop 50% in just three years. He ran out of money by age 81.

That’s the sequence of returns risk — and once the damage is done early in retirement, it's often irreversible.

Why Most Social Security Advice Falls Short

Many financial media outlets and “experts” recommend waiting until age 70 to file for Social Security. And on the surface, that advice can make sense. Higher monthly benefits, better longevity protection, and sometimes higher Monte Carlo probabilities of success.

But here's the problem: those recommendations are often made in isolation.

They don’t take into account:

-

The order of withdrawals from different account types

-

Roth conversion strategies

-

Tax impacts

-

Sequence of returns risk

-

And your actual lifestyle and emotional needs in retirement

Most retirement software runs a basic breakeven analysis or shows you a “probability of success” score based on simulations. But that’s often geared toward one goal: having the most money at the end of your life.

That’s not how real people make decisions. Once you’ve confirmed your money will last, it’s time to move past the software and make the decision that’s right for you.

A Real Example: Rob and Korey

Let’s look at a real-world planning scenario.

Rob and Korey were both 62 and newly retired. They wanted $10,000/month in after-tax income. Their savings included:

-

$1.9 million in pre-tax accounts

-

$400,000 in a joint brokerage account

-

$75,000 in Roth IRAs

Their Social Security benefits:

-

One spouse: $3,300 at full retirement age

-

The other: $2,000 at FRA, plus a $900 monthly pension

Like many retirees, they were trying to decide when to file:

-

Both early (age 62)

-

Both late (age 70)

-

Or a split strategy — lower earner at 62, higher earner at 70

We modeled each of these options against a negative sequence of returns, using actual market data from 2000–2023 with a 60/40 portfolio.

The Results Were Eye-Opening

-

Filing at 62 preserved the most in their investment accounts — by a lot.

-

The split strategy came in second.

-

Waiting until 70 had the lowest account balances throughout retirement.

Why? Because filing early reduced the need for portfolio withdrawals during the market downturn. Less pressure on the portfolio = more long-term preservation.

And not only that — filing early also resulted in lower cumulative taxes. With smaller withdrawals from pre-tax accounts, their taxable income stayed lower over time.

In this case, early filing meant:

-

Higher balances

-

Lower taxes

-

And less stress in volatile markets

Should You File for Social Security Early?

No — at least not automatically.

This example worked well for this couple in this specific sequence of returns. But your situation is different. Your savings mix, income needs, and risk tolerance all play a role.

The point is this: you can’t make a good Social Security decision in a vacuum. You need to test multiple strategies, in the context of:

-

Different market scenarios

-

Tax planning

-

Roth conversions

-

And your personal goals

The Right Decision Comes from Clarity

Too many people make their retirement decisions based on generalized advice or software-generated probabilities. But no one will feel the pain of a bad strategy more than you.

That’s why I believe retirement planning is 50% data and 50% emotion. You need both the math and the mindset.

The only way to build confidence is to:

-

See real data

-

Understand the trade-offs

-

And test different scenarios until the right one becomes clear

When you have that kind of clarity, confidence follows. And with confidence, you can enjoy your retirement without second-guessing every decision.

Need Help Finding the Right Strategy?

This is exactly what my team and I help people do every day.

We’ll show you how your Social Security filing age, withdrawal strategy, and Roth conversions all fit together — under one clear, tax-efficient plan.

We’ll test different combinations and show you:

-

How each choice impacts your account balances

-

How taxes play into each strategy

-

And how to create a custom plan that works for you

If you're ready to see your retirement picture clearly, book a Retirement Clarity Meeting today.

Whether you work with us, do it yourself, or hire someone else — just make sure your plan is clear. Because without clarity, there’s no confidence.

And you deserve both.