Index Funds vs. Individual Stocks: Why One is a Smarter Bet

Mar 21, 2025

The argument between index funds vs. individual stocks can get almost as heated as a political discussion. Those who believe they can successfully pick stocks often speak about those who "only" buy index funds with a hint of condescension, implying that stock picking is the real path to wealth - but only if you know what you are doing. Much like the 45-year-old former high school jock reliving their glory days, they love sharing stories of how they hit it big by buying a certain stock at the right time. And they always knew before they bought it that it would be a hit.

Tales like these often fuel the belief that picking individual stocks can lead to massive profits and market outperformance. However, a closer look at the data reveals a sobering reality: buying individual stocks is much like gambling, with the odds heavily stacked against the average investor. On average, picking stocks is a losing game, and a diversified investment approach is generally a much smarter strategy.

Before we discuss the data on the index funds vs. individual stocks debate, let's cover the two main options for investing in stocks and understand the pros and cons of each.

Understanding Your Stock Investment Options: Individual Stocks vs. Index Funds

When investing in stocks, you have two broad options:

1) Buy Individual Stocks

This approach involves analyzing specific companies and making predictions about whether their share prices will rise. It requires assessing a company’s financial health, growth potential, industry trends, and other factors.

For example, suppose you invest $5,000 in 100 shares of XYZ Company at $50 each. That’s a concentrated bet on one company. If the price rises to $70, your investment grows to $7,000. But if it falls to $30, your investment drops to $3,000. The performance of individual stocks can be volatile and unpredictable, which makes this strategy high risk and time-intensive.

2) Buy a Package of Stocks

Rather than betting on a single company, this approach gives you exposure to a broad group of companies through exchange-traded funds (ETFs) or mutual funds.

- ETFs are typically passive investments that track a market index like the S&P 500. They offer low fees, broad diversification, and the flexibility of trading like a stock.

- Mutual funds can be either actively or passively managed.

- Actively managed funds try to outperform the market by picking individual stocks but typically charge higher fees and often underperform. NOTE: See my article on index funds vs. actively managed funds for more details.

- Passively managed mutual funds, like ETFs, simply aim to match the performance of a market index.

For the purpose of this comparison, we’ll focus on index funds — which include both ETFs and passively managed mutual funds — as they represent a diversified, low-cost way to invest without trying to beat the market.

Measuring the Performance of Index Funds vs. Individual Stocks

Now that we’ve narrowed down the viable avenues to buy stock to either index funds or individual stocks, here’s how you should measure performance. To see how well a stock investment is doing, you need something to compare it to. The S&P 500 is a popular choice for this. It’s an index of 500 of the biggest companies in the U.S. and is often used to measure how the overall stock market is performing because it includes a wide variety of industries and sectors. By comparing your stock or portfolio to the S&P 500, you can see if your investment is doing better, worse, or about the same as the general market.

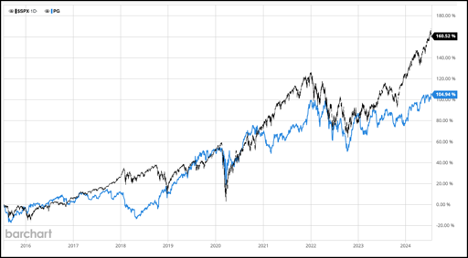

For example, in the chart below, you can see how Procter and Gamble's stock performance (blue line) compares to the S&P 500 index (black line) over the past 10 years.

Note: For the purposes of this article, we assume that you are making the individual stocks vs. index funds decision based on larger stocks and thus indexed to the S&P 500. If buying small, medium, or international stocks, another index would be more appropriate.

To understand how index funds became the go-to investment strategy for millions, it helps to know how they got started — and how much skepticism they initially faced.

In the late 70s, a visionary by the name of Jack Bogle recognized that if the S&P 500 was being used as a benchmark, why not make it available as an investment? He started the First Index Investment Trust on December 31, 1975. That fund was later renamed the Vanguard 500 Index Fund, which tracks the Standard and Poor's 500 Index. Today, the three largest ETFs as measured by assets under management all track the S&P 500.

When Vanguard first released the index fund, there was a lot of pushback. In the circles of money managers, it was referred to as “Bogle’s Folly.” The thought of buying a stock index fund was ridiculed. Why would anyone be satisfied with an investment that promised nothing more than the same return as the market?

Although the years of returns have quieted most of the naysayers, there are still plenty of people out there who promote the idea that they can buy individual stocks and beat the return of the market. In practice, most of these firms rely on their ‘stock picking secret sauce’ to justify charging a 1% fee. Those portfolios with 100 or more stocks picked by their “investment committee” look impressive and are designed to convey the impression that extensive analytical formulas and deep academic knowledge contributed to their creation. In reality, this is the equivalent of muddying the water so you can't see how shallow it is. As they say in sailing, "If you can't tie a knot, tie a lot."

The evidence continues to support what index fund investors have known for decades: trying to beat the market is a gamble. Owning the market is the smarter move.

The Performance of the S&P 500 vs. Individual Stocks

Research from JP Morgan reveals that each year, on average, 151 individual stocks in the S&P 500 end with a negative return of 5% or more. Given that the S&P 500 includes approximately 500 stocks, this means that nearly 30% of the stocks in the index perform poorly in any given year.

This data from JP Morgan demonstrates that while the S&P 500 as a whole may be a reliable investment over the long term, the experience of holding individual stocks can be vastly different. The likelihood of picking a stock that significantly underperforms or even loses value is alarmingly high, even in years when the market is generally up. This reality sets the stage for understanding why individual stock picking can be a gamble, and why a diversified approach might be a more prudent investment strategy.

The results of picking individual stocks are even more damning when you look at a study from Arizona State University. In this study, they compared the performance of stocks to the returns investors could have achieved if they had invested in the safer, more stable one-month Treasury bills instead. They called this Shareholder Wealth Creation (SWC). The intention was to assess whether the riskier choice of investing in stocks truly leads to higher returns.

They examined the individual returns of 28,114 stocks from 1926 to 2022. The findings were striking: 58.6% of these individual stocks reduced shareholder wealth. In other words, more than half of the stocks led to losses rather than gains for investors.

The study also found that a very small fraction of firms account for a significant portion of net wealth creation. For example, from 1926 to 2022, only 0.011% of firms (3 out of 28,114) were responsible for 10% of the net wealth creation. Similarly, 50% of net wealth creation was attributed to just 0.256% of firms. This concentration indicates that the majority of wealth creation comes from a minuscule number of stocks, making it incredibly challenging to consistently pick these winners.

While beating the market is possible, the odds are overwhelmingly against you. Index funds don’t just offer diversification — they offer a strategy backed by decades of data. Unless you truly believe you’re one of the rare few who can pick winners consistently, the smart money is on buying index funds.